Making taxes less taxing for gig workers

Fifty-seven million Americans, more than one-third of the nation’s workforce, are employed in the gig economy, according to a recent Gallup poll.

Many who join the rapidly growing throngs of Uber drivers, Instacart shoppers, freelance graphic designers, and dog walkers have two things in common: they are classified as small business owners by the IRS and they have little to no accounting expertise.

“So many gig workers are out of sync with their tax responsibility,” said Paul Koullick, A.B. ’14, an applied math concentrator at the Harvard John A. Paulson School of Engineering and Applied Sciences. “Gig workers are classified as business owners, and so a lot of things they buy are tax write-offs, even though they often don’t think about them that way.”

Enter Keeper, a startup Koullick co-founded with David Kang in 2018. A virtual bookkeeper, the software uses artificial intelligence to monitor credit card purchases and automatically identify, and record tax deductions in real time.

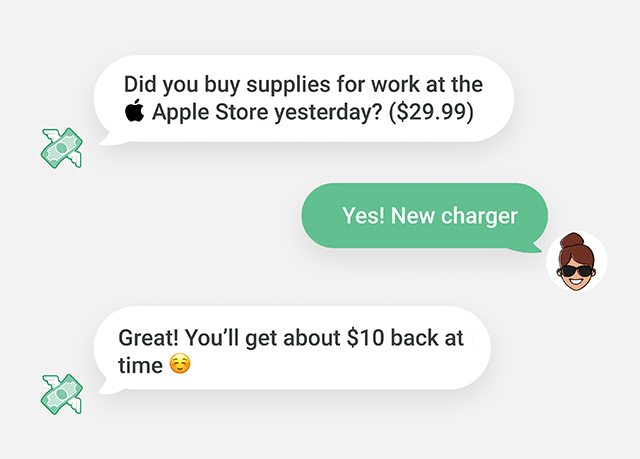

A machine-learning algorithm flags and categorizes credit card transactions. If the algorithm lacks confidence in a potential tax write-off, it passes it along to a human bookkeeper for verification. Then the software sends the user a text message asking them to confirm.

The text messages are designed to be light and fun, Koullick explained, and clearly identify the amount of money the user will save at tax time.

“There are constantly tax write-offs that we just let pass us by because taxes are complicated and they happen later. We wanted to find a way to make taxes exciting and immediate,” he said. “When you see how much these tax write-offs are worth, over time that adds up, and it is exciting. Most of the time, when you think about tax write-offs, it is because you have to. We want you to think about it because you want to.”

As a startup co-founder, Koullick understands how important, but tedious, the nitty-gritty details of business can be. From the moment he arrived at Harvard, he was set on building companies.

As an undergrad in the course Startup R&D (ES 95r), taught by Paul Bottino, Executive Director of Innovation Education, Koullick took his first crack at entrepreneurship. He and a few classmates built a business that would donate a condom for every condom it sold.

“That was very much a failed experience, but with startups especially, there is no other way to learn,” he said. “Being a founder, it takes a different kind of perseverance. I imagined entrepreneurship to be this glorious path for my life, but it isn’t very glorious at all. There isn’t much positive reinforcement, there’s a lot of grunt work day-in-day-out, and it can be a painful process.”

Even though entrepreneurship may have lost a bit of its shine for Koullick, he kept the experience in his mind when he joined financial services company Square as a product analyst after graduation.

Working at a late-stage startup taught him valuable lessons about how company-building works from the inside.

“There is no free lunch in entrepreneurship,” he said. “Pretty much every field has competitors who have been thinking about it for a long time and know much more about it than I do.”

In his next role, as head of tax product at Stride, Koullick’s team built and grew Stride Tax, a mileage and expense tracking app for small businesspeople.

As he learned more about the tax plight of gig workers, Koullick identified the as-yet unsolved problem that inspired him to launch Keeper. With his background in computer science and applied math, building the technology was the easy part, he said.

Explaining the technology to customers and investors, convincing them it is important, and creating a delightful user experience were bigger challenges.

“If you have conviction about a direction, you are likely to go further, but in entrepreneurship, you often don’t have all the information you need. A lot of the times, you’ll realize you’ve been paddling in the wrong direction,” he said. “You have to combine a tendency to paddle wholeheartedly, with the humility to know that oftentimes you will be wrong and will need to turn the whole ship around.”

Koullick and Kang have been paddling hard, and Keeper has surpassed 1,000 paying subscribers. The startup, which recently raised $1.6 million from investors and spun out of the Y Combinator accelerator, is hiring engineers and product developers to help meet increasing demand.

As the company grows, the challenges Koullick faces grow as well, but he relies on his grit, creativity, and passion to drive Keeper toward continued success.

“I get excited when we are able to open our customers’ eyes to something that benefits them, that they weren’t aware of,” he said. “One of the rewards that wakes me up in the morning and makes me love what I do, is that we are serving people who oftentimes live paycheck to paycheck. Our work is helping them keep more of their money, to not give away $2,000 at the end of the year.”

Do you have an interesting story you'd like to share with your fellow alumni? We'd love to hear from you! Contact the SEAS Office of Communications.